Assalamualaikum

Jom perbaharui takaful dan roadtax kereta anda bersama Agensi Khiron.

Assalamualaikum

Jom perbaharui takaful dan roadtax kereta anda bersama Agensi Khiron.

What is Motor Takaful? A motor takaful plan covers you against

Cover against third party risks in Malaysia was made compulsory under the Road Transport Act 1987. It is an offence for any person to use or cause or permit any other person to use a motor vehicle without the necessary coverage.

GET YOU MOTOR TAKAFUL NOW! CLICK HERE!

Takaful Concept in Motor Takaful When you participate in motor takaful, you contribute a sum of money to a general takaful fund in the form of participative contribution (tabarru’). You undertake a contract (aqad) for you to become one of the participants by agreeing to mutually help each other, should any of the participants suffer a loss because of an accident involving his vehicle.

Types of Motor Takaful Cover There are THREE (3) types of cover:

| Comprehensive | This protects you against the third party’s death, bodily injury and/or property damage; as well as loss and/or damage to your vehicle due to accidental fire, theft or an accident |

| Third Party, Fire and Theft | This protects you against third party’s fire, theft, death, bodily injury and/or property damage. |

| Third Party | This protects you against third party’s death, bodily injury and/or property damage. |

Who is a Third Party? A third party is a person who is injured or has suffered loss or damage arising from an accident involving your motor vehicle. A third party may be a pedestrian, a driver or passengers in another vehicle. The first party to a motor takaful plan is you as the vehicle owner and the second party is the takaful operator.

How much should I cover? Make sure that the amount covered in your motor takaful certificate reflects the market value of your vehicle, i.e. the cost of replacing your vehicle with a similar make, model and condition. If the amount covered is less than the market value, the average condition will apply in the event of a claim. The average condition is a penalty for underinsuring your vehicle. Underinsuring means the sum covered at the time of loss is less than the market value.

EXAMPLE : The sum covered is RM80,000 while the market value of the vehicle is RM100,000 and the loss is RM5,000. The average condition will operate as follows: The takaful operator will only pay RM4,000 instead of RM5,000 for the loss. You have to bear the difference of RM1,000.

What is a ‘No Claim Discount’ (NCD)? This can be regarded as an incentive to you for not making a claim during the preceding period of motor takaful cover and is given upon renewal of certificate as per scale below:

Takaful Period Discount

| After the first year of Takaful | 25.00% |

| After the second year of Takaful | 30.00% |

| After the third year of Takaful | 38.33% |

| After the fourth year of Takaful | 45.00% |

| After the five or more years of Takaful | 55.00% |

The NCD is be transferable to another takaful operator/ insurance company or another vehicle that belongs to you.

Cancelling Your Certificate You may cancel your certificate by giving 14 days’ written notice to the takaful operator. Upon cancellation, you are entitled to a pro rata refund of the takaful contribution on the unexpired period of takaful. When you cancel your certificate, you must surrender the motor certificate and the certificate of takaful to the takaful operator. You have to make a Statutory Declaration if the certificate of takaful is lost or destroyed. The certificate will be invalid once the motor vehicle has been sold to another person. The new owner will need to take new takaful coverage.

Excess The takaful operator may, as stated in the certificate, impose excess on the motor takaful plan. Excess is the amount of loss you have to bear before the takaful operator will pay for the balance of your claim. In other words, the excess amount will be deducted before the final claim payment. Example: If the amount of excess is RM1,000 and the amount of claim is RM1,500, the takaful operator will only pay you RM500.

Betterment Betterment occurs when, in the course of repairing an accident vehicle, an old part is replaced with a completely new one. For example, if your old bumper is replaced with a new one, you have to bear the difference in cost between the old and new bumper, in line with the principle of indemnity. This is because your contribution to the takaful plan is based on the amount covered. This amount, in turn, depends on the value of your vehicle, which will usually be lower than a new one.

Loss of Use If you are in an accident and you make a third party claim against the certificate or policy of the person who caused it, you can also claim for loss of use of your vehicle under repair. Loss of use includes items such as the cost of taking alternative transportation or of hiring a replacement vehicle (of similar type and cubic capacity). The period of loss of use is based on the independent loss adjuster’s recommendation on the number of days required for your car to be repaired. Takaful operators, at their own discretion, may allow an additional 7 working days’ grace period for any unforeseen or unavoidable delay.

Exclusions Motor takaful will not cover the following:

Extensions With additional contributions, you can extend the standard motor takaful plan to cover the following:

Flood damage to your vehicle is expensive to repair. Let Etiqa take up the bill! Add Flood and Storm Extension when you purchase your motor takaful with us.

How do I make a claim? Involvement in a Motor Accident If you are involved in a motor accident, the general rules that you need to observe are:

| Documents Needed | |

|

Certified Copy of Police Report (applicable for Motor accident) (malicious damage claim) |

|

| Copy of Vehicle Registration Card | |

| Copy of Insured’s MyKad/ ID or Business Reg. License (if insured is a company) | |

| Copy of Insured’s Driving License | |

| Copy of Driver’s MyKad/ ID | |

| Copy of Driver’s Driving License | |

| Vehicle Permit (applicable for commercial vehicle) | |

| For WINDSCREEN CLAIM MUST HAVE : | |

| Zoomed view of the damage or breakage BEFORE repair/replacement of the windscreen with vehicle pillars (mandatory) | |

| Full view photo AFTER repair/replacement of windscreen & Vehicle’s Plate No. with date imprinted (mandatory) | |

| Zoomed view of the damage or breakage AFTER repair/replacement of the windscreen with vehicle pillars (mandatory) | |

| Original Receipt/ Bill/Invoice with company’s letter head (mandatory) | |

| Photo of Chassis Number with date imprinted. (mandatory) | |

| Payment Instruction order/Authorization letter – if pay to non-panel workshop (provide workshop’s Maybank Account No.) (mandatory) | |

| For OUTPATIENT CLAIM | |

| Outpatient Claim – Police Report (applicable for Motor accident) (mandatory) | |

| Outpatient Claim – Medical Report (mandatory) | |

| Outpatient Claim – Original Medical Bills & Receipts (mandatory) | |

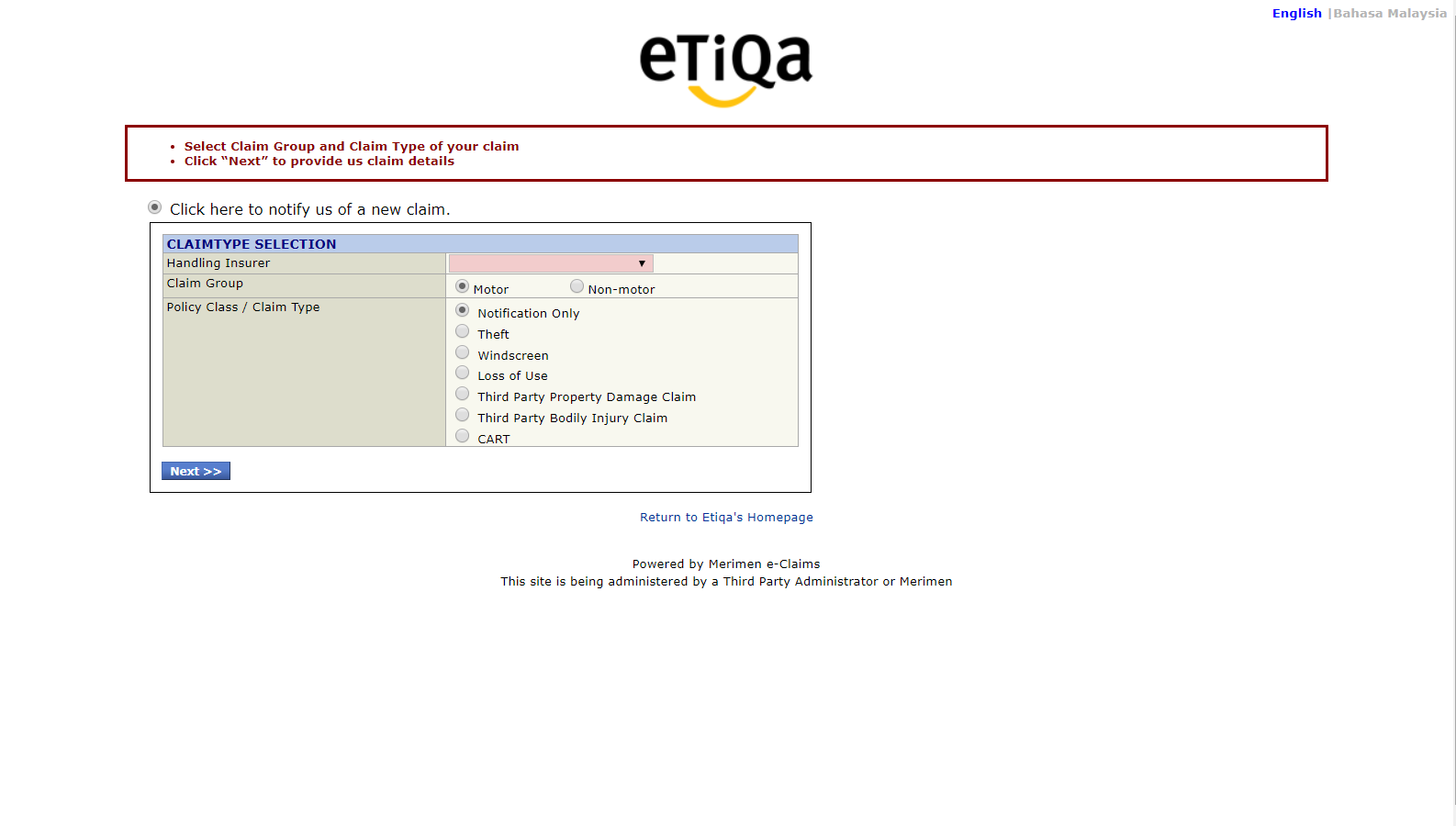

YOU CAN MAKE CLAIM ONLINE TOO! CLICK THIS LINK HERE

AND YOU WILL GO TO THIS PAGE. JUST KEY IN AND FOLLOW THROUGH. UPLOAD YOUR DOCUMENTS AND ALL DONE!

Claim involving Damage to Your Vehicle

Claim Involving a Third Party

Claim as a Third Party

Claim involving Theft of Your Vehicle

Source : Etiqa Takaful.

Takaful Houseowner & Householder. What’s that?

well how about a video to explain what is Takaful Houseowner & Householder to you.

So to summarize, Takaful Houseowner cover the physical structure of your house while Takaful Houseowner cover the content in the house. The two can be combine for optimum coverage ; Takaful Houseowner & Householder.

Below here, I prepare a table as a rough guidance to the pricing for this takaful. This pricing is for a typical 2-storey house. However, if your house is not that typical and you think the pricing doesn’t feel right to you, feel free to call us anytime and we will prepare a personalized quotation just for you.

want an easier method rather than calling our office? Whatsapp us!

013 – 293 7289

Whatsapp me your details includes :

and TADAA! we will prepare you a personalize quotation for your house optimum protection.

or….. you can easily do it online (pay online too with M2U/FPX) simply click HERE

Assalamualaikum,

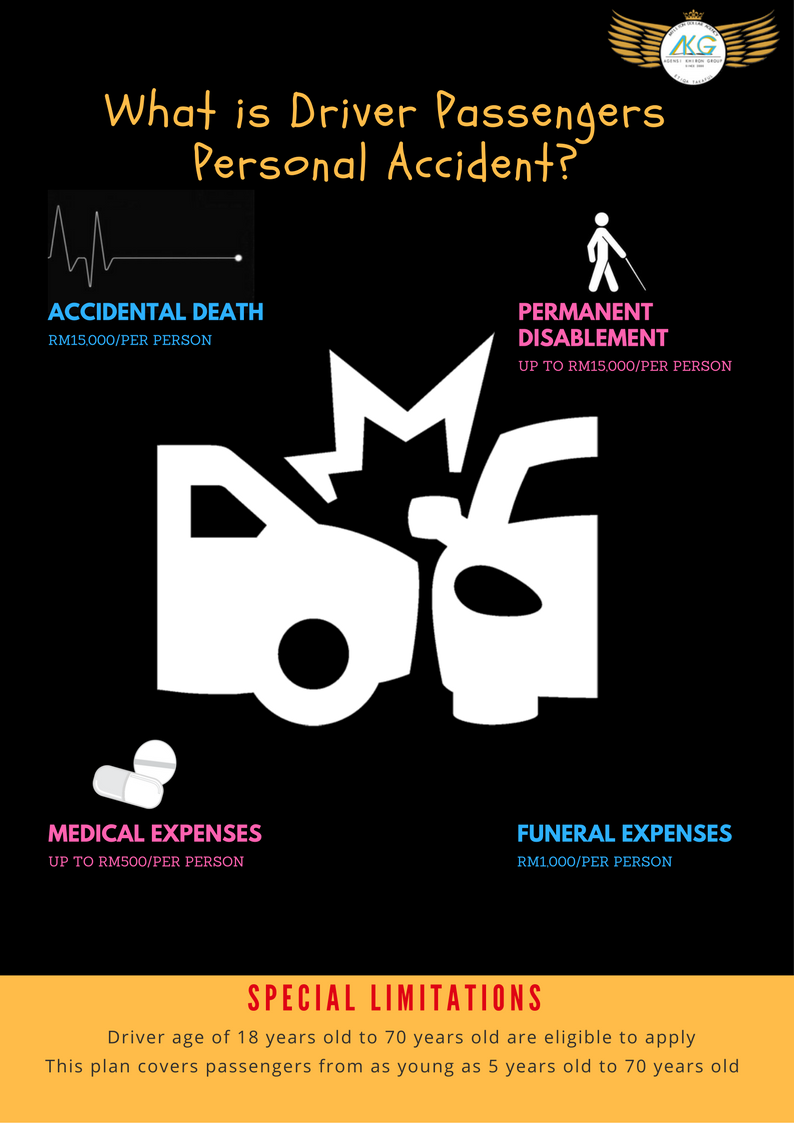

hari ni nak terangkan pasal DPPA. DPPA ni penting taw sebab selalunya bila orang ambil /renew takaful kenderaan, orang selalu ingat yang tulis “sum covered” dalam cover note tu termasuk sekali cover pemandu dan pemandu kedua (sekiranya ada).

TIDAK!!

Tak cover ya rakan rakan sekalian, takaful kereta tu cover kereta semata-mata. Itu pun kalau rosak sebab banjir / tanah runtuh tak cover kalau tak ambil additional coverage for special perils.

Sekali lagi saya katakan, tidak cover ya…

Katakanlah kalau accident (nauzubillah) kereta remuk, pemandu dan penumpang meninggal (nauzubillah), kalau tak ambik DPPA tak dapat pampasan ya. Dapat untuk kereta sahaja.

Tapi kalau ambik DPPA ni, pemandu dan penumpang juga akan dilindungi.

Manfaat-manfaat DPPA

DPPA ni RM 78.90 sahaja setahun untuk kereta 5 seater, kalau 7 seater RM 104.35 that means kalau kita bahagikan ikut hari dalam setahun, hanya RM 0.22 sahaja sehari. Berbaloi-baloi kan?

Okay. Mesti ada yang macam terdetik dalam hati, habis tu kalau tak accident? duit tu pergi mana? Well, itu kita kena elaborate pasal konsep takaful pula but basically, duit yang anda sumbangkan tu disalurkan ke jalan yg bermanfaat untuk semua pemegang polisi takaful dan bukannya untuk keuntungan syarikat semata-mata.

Akhir bicara, saya sangatlah galakkan anda ambil DPPA ni. Malang tak berbau, kita tak tahu apa nak jadi di masa hadapan, seeloknya kita bersedia dan beringat-ingat. Bukannya mahal sangat pun, RM 78.90 sahaja. Keluar duit setahun sekali sahaja. Okay lah kan?

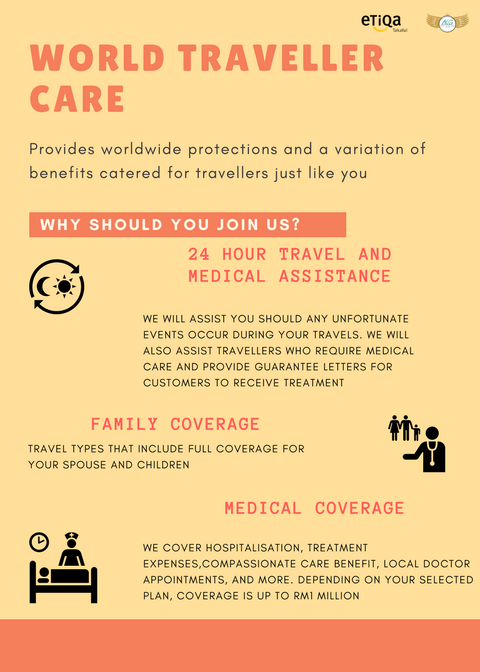

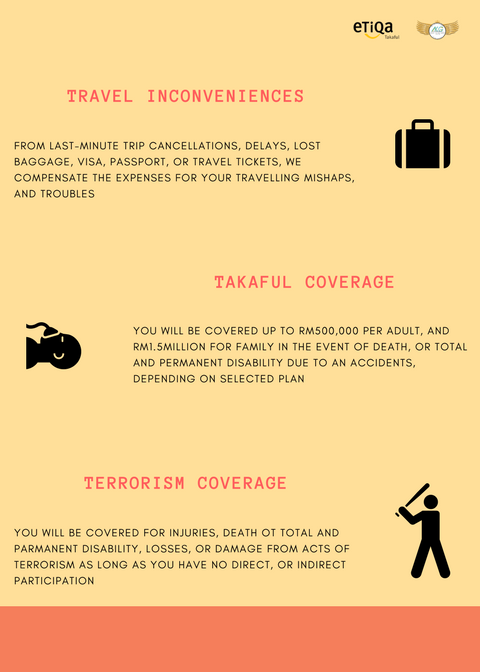

Anda merancang untuk ke luar negara? Melancong Bersama keluarga dan rakan?

Pastikan perjalanan anda dilindungi plan takaful dengan harga yang berpatutan.

Tahukah anda Etiqa Takaful akan membayar pampasan kepada semua pelanggan plan [ PLATINUM ] dan [ GOLD ] sekiranya penerbangan tertangguh lebih dari 6 jam?

Mudah sahaja! Klik link ini –> https://goo.gl/qmZkv1

Perhatian warga Putrajaya! Anda tidak perlu jauh-jauh renew insurans (takaful) kenderaan anda. Pejabat kami terletak di Presint 15 (Presint Diplomatik). Berdekatan dengan Mydin, Public Bank, atas Kopetro Travel, berhadapan dengan Etiqa.

Susah cari parking? Tiada masa?

hubungi kami atau whatsapp kami untuk menguruskan insurans & roadtax anda secara online.

anda juga boleh klik sini

Road accidents can happen to us anytime. When an unexpected car accident happen, it can leave us feeling confused which may resulted in us seeking help from unknown parties.

We wish to advise consumers that it is important to be fully informed on the correct procedures to be adopted in an event of an accident to ensure that the consumers’ interests are protected.

Firstly, a vehicle owner must understand that purchasing an insurance policy/contributing to Motor Takaful is not only for the renewal of his road tax and to drive legally on the road. An insurance cover/Takaful participation can protect the vehicle owner in the case of an accident. In this instance, the vehicle owner must know the various types of motor insurance covers, such as:-

Third Party cover: This policy/Takaful Certificate insures/protects you against claims for bodily injuries or deaths caused to other persons (known as the third party), as well as loss or damage to third party property caused by your vehicle.

Third Party, Fire and Theft cover: This policy provides insurance/Takaful protection against claims for third party bodily injury and death, third party property loss or damage, and loss or damage to your own vehicle due to accidental fire or theft.

Comprehensive cover: This policy/Takaful Certificate provides the widest coverage, i.e. third party bodily injury and death, third party property loss or damage as well as loss or damage to your own vehicle due to accidental fire, theft or an accident.

As soon as your car is involved in an accident, we advise you to take the following steps, regardless of who was at fault to ensure the reporting process after the accident is less stressful and smoother when making your insurance/Motor Takaful claim.

What must you DO?

What must you NOT do?

Once you have lodged a police report, you can proceed to make a claim with your insurance company/Takaful Operator:-

If you choose to pursue a motor claim involving third party bodily injury and death or third party property damage directly with the driver’s insurer/Takaful Operator or appoint a lawyer, always ensure that the compensation that you receive is adequate. Please exercise care and where necessary seek expert advice in reaching any settlement for compensation with the other vehicle’s insurer/Takaful Operator as such settlement is likely to be final.

Together with this post, we include a video from Etiqa regarding motor takaful.